This article is a summary of the June book industry news. And yes, I have written about the potential acquisition of Simon & Schuster again.

- Legendary Knopf and New Yorker Editor Robert Gottlieb Dies at 92

- Industry Financial News

- Another Big Five Merger Attempt Around the Corner?

- Hachette Livre Got Acquired

- Ross Yoon Agency Changed Ownership

- Wiley on Its Way to Restructurisation

- Did Big Five and Amazon Fix E-book Prices?

- W.W. Norton, a Large Independent Publisher, Celebrates its 100th Anniversary

- Penguin Random House and Del Rey UK Launch Inklore

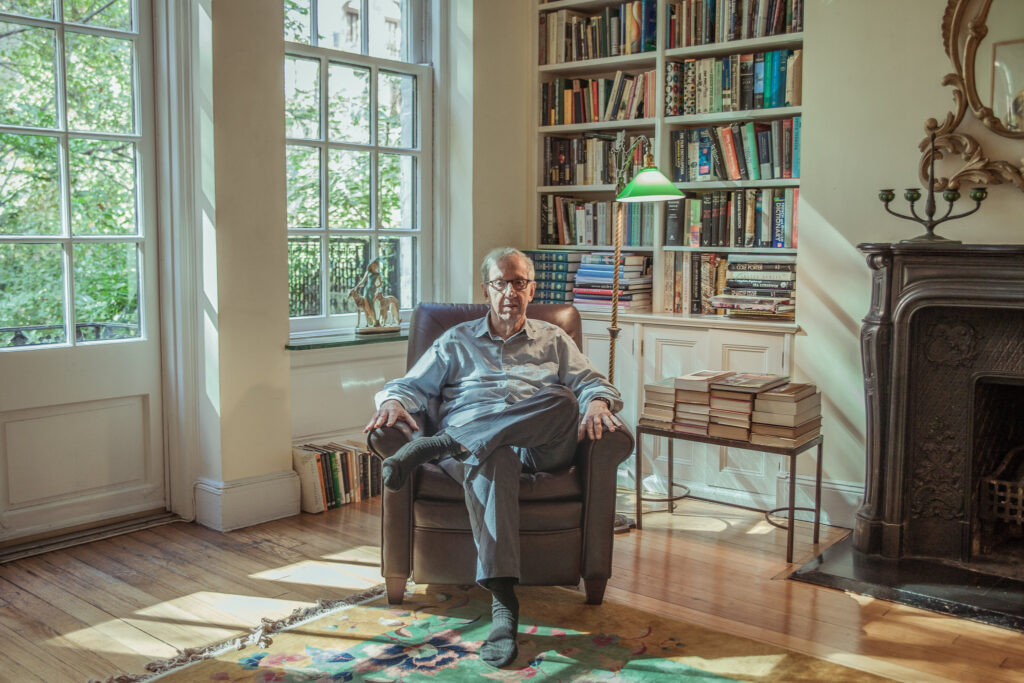

But before we proceed with all the business stuff, let’s pay a moment of respect to Robert Gottlieb, a literary colossus, who passed away a few weeks ago.

Legendary Knopf and New Yorker Editor Robert Gottlieb Dies at 92

On June 14, 2023, the world lost Robert Gottlieb. He died of natural causes at New York-Presbyterian Hospital.

During his very long stellar editing career Gottlieb worked with such famous authors as Ray Bradbury, Robert Caro, John Cheever, Doris Lessing, John le Carre, Michael Crichton, Toni Morrison, Salman Rushdie, Robert Massie, Nora Ephron among many others.

Robert A. Caro, with whom Gottlieb had the longest working relationships, said: “I have never encountered a publisher or editor with a greater understanding of what a writer was trying to do — and how to help him do it. From the day fifty-two years ago that we first looked at my pages together, Bob understood what I was trying to do and made it possible for me to take the time, and do the work, I needed to do. People talk to me about some of the triumphant moments Bob and I shared, but today I remember other moments, tough ones, and I remember how Bob was always, always, for half a century, there for me. He was a great friend, and today I mourn my friend with all my heart.”

My heartfelt condolences to the loved ones of Robert Gottlieb.

Industry Financial News

Total publishing industry sales grew by 3.2% in the first quarter of 2023. The primary drivers of the growth were digital audio sales, which were up 18.7%, sales of adult books, which have shown a 3.5% upward trend, and religious books (up 3.1%). While the main ‘divers’ were hardcover sales (minus 7.6%), children and young adult books (minus 4.6%), and university presses (3.6% down).

While Q1 was quite good, the month of April wasn’t that successful, with sales down by 7.6%, compared to March. Among the ‘leaders’ of the fall were adult books (minus 12.8%), university presses (12.0% down), and children’s/young adult books (9% down). Amid the overall slump some sectors showed growth – digital audio sales went up by 5.8%, and higher education course materials grew by an impressive 32.8%. Despite the decline, some optimism can be drawn from the fact that the total industry sales in April increased by 0.9% year over year.

Another Big Five Merger Attempt Around the Corner?

HarperCollins Publishers and KKR & Co are emptying their piggy banks to secure a competitive bid for Simon & Schuster, according to Wall Street Journal. Considering that both Wall Street Journal and HarperCollins Publishers are owned by News Corp, this information is unlikely to be just a rumour.

Regardless of Penguin Random House recent futile attempt to acquire Simon & Schuster, HarperCollins is optimistic about its own effort. Maybe they think that their lawyers are more skillful than those of PRH.

According to Circana BookScan, HarperCollins is the second largest publisher in the US, with 11% of the market. Simon & Schuster, with 6%, occupies the third position. So together, should the acquisition slip through the legislative barriers, the companies would control about 17% of the market, still behind Penguin Random House (21%).

According to some sources, the new bids for Simon & Schuster are expected in mid-July, with Paramount Global, the parent company of Simon & Schuster, hoping to strike a deal before the autumn. So it’s high time to buy some popcorn and make yourself comfortable for another season of ‘Simon & Schuster acquisition’ series.

Hachette Livre Got Acquired

While Simon & Schuster is struggling to get sold, Lagardère, the parent company of another Big Five publisher Hachette Livre, got acquired by Vivendi, the parent company of Canal+ Group.

Vivendi had to sell 100% of its publishing group Editis to receive the deal approval from the European Commission.

Lagardere had a very successful year in 2022, when its revenue grew by more than 28% to $7.42 billion. So, based on 2022 figures, Vivendi is expecting its annual revenue to increase to approximately $18 billion from the current $10.7 billion after the acquisition.

“We are eager to see the teams of our two groups pool their know-how and capitalize on their respective complementarities to accelerate the development of our activities and provide exciting new perspectives to the many talents who have placed their trust in us,” said Arnaud de Puyfontaine, Vivendi’s CEO.

Ross Yoon Agency Changed Ownership

William Morris Endeavor purchased literary agency Ross Yoon Agency. Ross Yoon’s president Gail Ross and principal Howard Yoon joined WME as partners after the acquisition. Ross Yoon’s clients will get transferred to WME as well.

In 2022, WME’s book department managed to close about a thousand publishing deals around the world, and more than 50 of its titles made it to the New York Times bestseller list.

“This acquisition is a natural evolution of WME’s long history of representing bestselling authors and helping bring their visions to life across platforms,” said WME co-chairmen Christian Muirhead and Richard Weitz. “We are proud that after so many hugely successful independent years Gail and Howard chose WME as their partner in this next phase of growth.”

Wiley on Its Way to Restructurisation

John Wiley & Sons, Inc., commonly known as Wiley, is a producer of training and educational materials. During the course of its more than two-hundred-year history, the company has grown to a huge international business with thousands of employees in more than 20 countries.

After a tough fiscal 2023, the company will restructure by divesting its non-core educational businesses. In the future, it will concentrate on the research and learning markets.

According to Wiley officials, the company will divest its university services, Wiley Edge and CrossKnowledge programs. Together these businesses generated 19% of Wiley’s revenue ($393 million) and 10% of adjusted EBITDA ($43 million) in fiscal 2023.

“Today we are announcing strategic actions that will make Wiley simpler, stronger, and more profitable by focusing on our long-standing position as a global leader in research, publishing, and digital solutions,” said Brian Napack, Wiley president and CEO. “The actions that we are now taking will allow us to materially improve our performance and margins in fiscal 2025 and 2026, and position us for sustained, profitable growth in the years ahead.”

Wiley’s profits are expected to decline in fiscal 2024. However, Brian Napack is optimistic about the company’s future. “We expect to begin realizing benefits from all these actions later in fiscal 24. Building toward their full realization in fiscal 25 and 26 and beyond,” he said.

Wiley’s CEO also has high hopes for generative Al. “We believe these technologies provide real opportunities to enhance both our competitive position and our profitability, and we’re working hard to enlist these powerful tools to improve content creation, our platforms, and our production processes,” he said.

Did Big Five and Amazon Fix E-book Prices?

Apparently, Simon & Schuster acquisition isn’t the only recurring event in the publishing world. At the beginning of 2021 the law firm Hagens Berman filed a civil law suit against Amazon. It accused the e-commerce giant of collaborating with the Big Five publishers to limit price competition in the e-book market. About a year ago, Judge Valerie Figueredo determined that there was not enough evidence to proceed with the original case, resulting in a retrial.

The judge had appointed oral arguments for June 22. Amazon and the Big Five publishers, obviously, tried to make the updated lawsuit go the way of its predecessor – get dismissed. So far I haven’t found any information regarding the result of the arguments. Who do you think will succeed?

W.W. Norton, a Large Independent Publisher, Celebrates its 100th Anniversary

While some companies get acquired, others remain independent and seem quite happy with that. W.W. Norton & Company, which this year has become a century old, is one of such companies.

Independence is at the core of the company. When William Warder Norton died in 1945, his widow and the company cofounder Mary Dows Herter Norton consequently declined more than 20 acquisition offers. Instead of selling the business, she transferred the ownership of the company to its employees. To ensure the company’s independence, Norton’s stock is always owned by its current employees, so if a shareholder decides to leave the company, the person must sell their shares back.

Thanks to this ownership model, the company management is not concerned with quarterly financial statements and can focus on the long-term development. “We have a long-game strategy”, Julia Reidhead, Norton’s president and chairman, said. “We can take our time to find our way”.

“We like to say we buy books for the future”, said Brendan Curry, director of the trade group. “If a book is late or doesn’t meet expectations, we don’t need to worry about what will happen to the stock price”.

About 650 people work at Norton, there are more than 10,000 titles in its backlist. The company works in both the trade and college segments, which is quite unusual these days, with most publishers focusing on one or the other.

Penguin Random House and Del Rey UK Launch Inklore

Inklore is a new imprint, which will specialize on publishing manga, manhua, manhwa, webcomics adaptations, and “light novels”. Penguin Random House and Del Rey UK started it in collaboration.

Manga, manhua, and manhwa are Japanese (manga), Chinese (manhua), and Korean (manhwa) comics.

According to PRH, Inklore will be “a pop-comics imprint celebrating the most popular, fan-driven tropes in visual storytelling, with a focus on digital-to-print licensed publishing in the romance, fantasy, science fiction, horror, and slice-of-life genres”. US and UK teams will be working closely with colleagues in Penguin Random House North Asia on promoting the artworks to readers worldwide.

The first title of the new imprint will be released in early 2024.

Conclusion

These were the major book industry news, which I considered either interesting or significant. Thank you for reading and see you in my new articles. Take care!